- Crypto Club 23

- Posts

- 🚀BOOM! Trump Unlocks Trillions, XRP Explodes, Ripple Goes Shopping

🚀BOOM! Trump Unlocks Trillions, XRP Explodes, Ripple Goes Shopping

SOC 2 in 19 Days using AI Agents

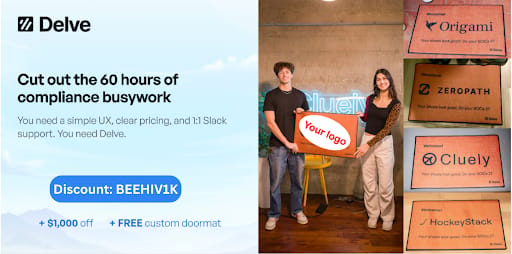

We’re Delve — the team that went viral for sending custom doormats to over 100 fast-growing startups.

That stunt? It cost us just $6K and generated over $500K in pipeline. Not bad for a doormat.

But if you haven’t heard of us yet, here’s what we actually do: Delve helps the fastest-growing AI companies automate their compliance — think SOC 2, HIPAA, ISO 27001, and more — in just 15 hours, not months.

Our AI agents collect evidence, generate policies, and prep everything while you keep building. And when it’s time to close your enterprise deal? Our security experts hop on the sales call with you.

We’ve helped companies like Lovable, Bland, Wispr, and Flow get compliant and grow faster — and we’d love to help you, too.

🚨 Crypto is Not Playing This Week! Big Moves, Big Wins, Big Trouble. Stay Sharp.

Look, crypto came in hot this week—and I don’t say that lightly. If you blinked, you’ve already missed something major. We’re talking courtroom victories, billion-dollar doors swinging open, and governments either giving green lights or throwing weighty chains. It's messy, it's brilliant—it’s crypto.

So here’s your no-fluff, deep-sauce recap of what just went down over the last 24 hours. I’ve also added some trades to keep you ahead of the curve—not behind it.

🇺🇸 Trump Just Gave Crypto the 401(k) Pass

Ladies and gentlemen, the $12 trillion retirement industry just got its walls kicked open. Trump has cleared the path for crypto to be included in 401(k) retirement plans—alongside real estate and private equity.

You heard that right.

That means institutional money is about to pour in like rain on dry ground.

No more side talk. This is direct policy-level backing.

🧠 What It Means:

Institutions now have zero excuses. The US government is saying “Yes, you can.” And that’s going to trickle down—fast.

💰 Trade Radar:

Keep your eyes on BTC, ETH, and GBTC (Grayscale Bitcoin Trust).

Also watch out for retirement-focused crypto ETFs that’ll likely pop up soon.

Conservative swing: COIN (Coinbase stock)—because they're the bridge for a lot of this new flow.

🚀 XRP Goes Ballistic – Crosses $3

Ripple and the SEC? Over.

And guess what? XRP wasted no time jumping past the $3 mark like it had something to prove. The years of legal limbo are done, and Ripple now has wind in its sails.

I don’t even need to exaggerate: this is a new chapter.

🔥 Market Pulse:

XRP ain’t just a trade—it’s a sentiment play. People are relieved. Investors are returning.

Plus, Ripple is already acquiring new companies (see below), so they’re not slowing down.

💰 Trade Radar:

Aggressive short-term play: Buy the dip on XRP, target $3.50+.

Long-term? Stack slowly. This is just the beginning of the “post-case” rally.

🏦 EU Drops the Hammer on Banks Holding Crypto

Meanwhile, in the regulatory freezer that is Europe, the EU just told banks:

“You want to hold unbacked crypto? Cool—just assign it 1250% risk weight on your books.”

Translation?

Holding crypto as a bank in Europe is now treated like betting your house on a coin toss.

📉 What It Means:

Institutional adoption in the EU just got sucker-punched. This will not be bullish for EU-based financial institutions trying to ease into crypto.

💰 Trade Radar:

Keep clear of EU crypto banks—like BBVA or ING, for now.

Instead, pivot to US exchanges and platforms where the sun is shining (COIN, RIOT, MARA).

💵 Ripple Buys $200M Stablecoin Firm – Big Stable Moves

While celebrating their court win, Ripple is also making power moves—dropping $200 million to acquire Rail, a stablecoin payments firm. They’re not playing safe—they’re playing strategic.

👀 What It Means:

Ripple’s RLUSD stablecoin project is about to get real infrastructure, real fast. Expect them to start competing with USDT, USDC, and other stablecoins across Asia and Latin America.

💰 Trade Radar:

Watch for Ripple partnerships announcements. These usually signal bullish catalysts.

Possible long-term stack: RLUSD, once it hits broader circulation.

🧱 Bitcoin Layer 2 “BOB” Raises $21M

DeFi on Bitcoin? You better believe it.

BOB just raised $21 million from Castle Island, Anchorage, and others to bring ZK-fraud proof rollups to Bitcoin.

Let me simplify that: Bitcoin’s getting smarter, faster, and more DeFi-capable. Ethereum better watch its back.

💰 Trade Radar:

Watch BOB’s upcoming token or platform launches.

Keep an eye on BTC-based DeFi plays (Sovryn, Rootstock ecosystem).

Early entry opportunities may be scarce—set alerts.

⚖️ Tornado Cash Dev Found Guilty

On a more serious note, Tornado Cash dev Roman Storm has been found guilty of running an unlicensed money transmitting service. One conviction, but a loud warning for every privacy protocol dev out there.

🧠 What It Means:

The war on privacy tools has leveled up. Regulators are saying: “Build it, and we’ll find you.”

💰 Trade Radar:

Privacy coins like ZEC, XMR, SCRT might feel the heat.

Or they might rally as acts of rebellion. Either way—it’s risky volatility territory.

🌍 Dubai + UAE Just Synced Crypto Licenses

In brighter news, Dubai and the UAE have finally aligned their crypto frameworks under a unified licensing system. That means less red tape, more institutional clarity, and better market confidence in the region.

💰 Trade Radar:

MENA-based projects like Crypto Oasis, Plexus could benefit.

Watch Dubai-based exchanges and platforms—growth incoming.

👇 Bottom Line

This space isn’t just moving—it’s transforming.

Retirement money is flowing in. Legal battles are being won. Infrastructure is scaling. Regulations are getting tighter in some regions, looser in others.

But the real ones?

They’re watching all of it—and positioning themselves for the next phase.

🧭 Trade Radar Summary

Opportunity | Action |

|---|---|

BTC & ETH | Accumulate dips, retirement fund fuel |

XRP | Ride post-lawsuit rally |

COIN | Strong US-based proxy for market inflow |

EU Banks | Stay away—heavy regulatory pressure |

BOB & BTC L2s | Track early access, low-cap gems |

RLUSD | Ripple’s stablecoin—watch rollout |

Privacy Coins | High risk, high reward—play cautiously |

The credit card experts have spoken

And you’ll wanna hear what they’re saying about this top-rated cash-back card.

The analysts at Motley Fool Money unlocked the secret to a one-card wallet, thanks to an unmatched suite of rewards and benefits that potentially give this card the highest cash-back potential they’ve seen.

The details:

up to 5% cash back at places you actually shop

no interest until nearly 2027 on purchases and balance transfers

A lucrative sign-up bonus

no annual fee

🚨🧱 The Explainer Corner: Why Layer 2s Are the Real MVPs of Crypto Right Now

Let’s take a break from all the market heat and courtroom drama, and talk tech — because understanding this one thing can literally change your earning game.

If you’ve ever tried moving ETH during peak hours and felt like you were getting robbed by gas fees, you’re not alone. ₦20,000 to send a token? Who does that help?

This isn’t just a pain point — it’s the biggest barrier to mass adoption. And that’s why Layer 2 networks aren’t just techy jargon anymore — they’re the unsung heroes of the crypto world.

🚀 What Are Layer 2s Really?

Imagine Ethereum is a road in Lagos during the rainy season. Jam everywhere. Then imagine someone builds a clean, private expressway right above it — no okadas, no potholes, no wahala.

That’s what Layer 2s are.

They’re built on top of Ethereum to handle more transactions at lower cost, without sacrificing security.

You still use Ethereum... just way smarter.

⚙️ How They Work – No Long Talk

Layer 2s aren’t all built the same. Here’s the quick cheat sheet:

Rollups – Compress thousands of transactions and post them as one on Ethereum.

Examples: Arbitrum, Optimism, zkSyncState Channels – You and someone else transact privately and only post the final result on-chain.

Example: RaidenValidiums / zk-Rollups – Add zero-knowledge proofs for extra speed and privacy.

zkSync is killing it here.

💰 Why This Matters (Especially If You’re on a Budget)

Gas fees drop from $15 to less than $0.10

Transactions go from 2 minutes to 2 seconds

Most important: Early users get rewarded 🪂

(Remember the Arbitrum airdrop? Over $1 billion given out for free.)

🔥 Trade on a Budget, Eat Like a Whale

You don’t need $10k to play DeFi anymore. Just move your ETH to Layer 2, and you’re good to go:

Arbitrum – The biggest Layer 2 right now. DeFi central.

Optimism – Coinbase backs this. Trust is high.

zkSync – Privacy + speed. Very likely to airdrop more.

Base – Coinbase's own L2. Easy for newbies.

🪂 The Real Plug: Testnets That Pay

If you're broke but active, read this twice:

Some Layer 2s are still in testnet (a.k.a. testing phase), and they’re rewarding early activity like it’s Christmas.

✅ zkSync Era testnet – Potential airdrop

✅ Linea, Scroll, Starknet – All testing, all dropping free money for effort

Imagine getting paid in tokens today that could be worth thousands tomorrow — just for using a dApp and sending a few fake tokens around. You’re literally building history and getting paid.

🧠 Final Words — Why You Can’t Sleep on L2

Crypto’s not waiting for anyone. It’s moving fast. But Layer 2s? They’re the foundation for crypto's next billion users.

This is not about hype. It’s about usability. And opportunity. And accessibility.

Don’t just hold tokens. Learn how the roads they move on are being upgraded — and use it.

Your action plan?

Bridge ETH to Arbitrum or zkSync

Use DeFi apps on testnets

Sign up for tools like Linea and Starknet

This is where the airdrops live. This is where the future plays out.

This is where broke turns to breakthrough.