- Crypto Club 23

- Posts

- 🔥 Market Surges, Trade Watch & The Banking Battle You Can’t Ignore

🔥 Market Surges, Trade Watch & The Banking Battle You Can’t Ignore

Run IRL ads as easily as PPC

AdQuick unlocks the benefits of Out Of Home (OOH) advertising in a way no one else has. Approaching the problem with eyes to performance, created for marketers with the engineering excellence you’ve come to expect for the internet.

Marketers agree OOH is one of the best ways for building brand awareness, reaching new customers, and reinforcing your brand message. It’s just been difficult to scale. But with AdQuick, you can plan, deploy and measure campaigns as easily as digital ads, making them a no-brainer to add to your team’s toolbox.

You can learn more at AdQuick.com

Hey fam,

Crypto’s been moving fast lately — from price jumps to subtle regulatory moves. To stay ahead, you need the full picture: what’s happening in the market, where smart money’s flowing, and the behind-the-scenes battles shaping the industry’s future.

Let’s dive in.

🚀 Market Snapshot: Bitcoin & Ethereum Surge

Bitcoin (BTC) has climbed to $121,683, marking a 2.86% increase over the past 24 hours.

Ethereum (ETH) is trading strong at $4,295.08, reflecting a 1.49% rise.

XRP continues its upward trajectory, reaching $3.26, with a daily high of $3.27.

🔥 Market Dynamics You Should Watch

Bitcoin Dominance has dipped by 3.22%, dropping to 60.5%, as altcoins gain momentum.

Ethereum’s Surge is driven by increased institutional buying and a tightening supply — already up 100% in 2025.

XRP’s Resilience is clear as it rebounds from a recent sell-off, signaling renewed investor confidence.

🌍 Global Regulatory Shifts

El Salvador passed legislation allowing investment banks with $50 million capital to hold Bitcoin and serve qualified clients — a major step toward institutional adoption.

Ukraine proposes a 10% tax on crypto holdings to align with EU transparency standards.

🧠 Strategic Insights: Layer 2 Networks on the Rise

Ethereum’s scalability issues are pushing Layer 2 solutions like Arbitrum and zkSync into the spotlight. These networks make transactions faster and cheaper — a must for mass adoption.

If you’re not already exploring Layer 2, now’s the time. They offer smoother, cheaper DeFi access, plus potential airdrops for early users.

📈 Trade Watchlist: Where to Focus Now

BTC & ETH: Hold your positions — institutional interest could push prices higher.

XRP: Watch for breakout points — momentum is building.

Layer 2 Projects: Keep an eye on Arbitrum, zkSync, and Optimism — poised for major growth as Ethereum scales.

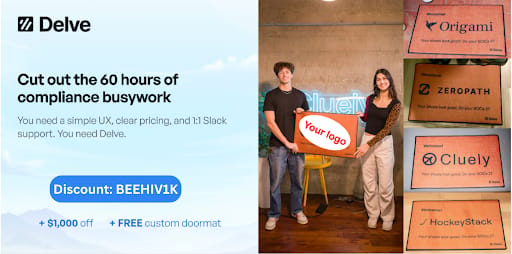

SOC 2 in 19 Days using AI Agents

We’re Delve — the team that went viral for sending custom doormats to over 100 fast-growing startups.

That stunt? It cost us just $6K and generated over $500K in pipeline. Not bad for a doormat.

But if you haven’t heard of us yet, here’s what we actually do: Delve helps the fastest-growing AI companies automate their compliance — think SOC 2, HIPAA, ISO 27001, and more — in just 15 hours, not months.

Our AI agents collect evidence, generate policies, and prep everything while you keep building. And when it’s time to close your enterprise deal? Our security experts hop on the sales call with you.

We’ve helped companies like Lovable, Bland, Wispr, and Flow get compliant and grow faster — and we’d love to help you, too.

🚨 Operation Choke Point 2.0: The Crypto Banking Blockade You Need to Know About

Alright, let’s get real. One of crypto’s biggest hidden hurdles isn’t just market swings — it’s getting banks to work with crypto businesses. That’s where Operation Choke Point 2.0 comes in.

What Is Operation Choke Point 2.0?

It’s a quiet government squeeze pressuring banks to cut off crypto firms. This isn’t a conspiracy — it’s real and happening under the radar.

The name comes from a past crackdown on “high-risk” industries. Now crypto is the target. Banks are scared to touch crypto accounts because regulators are watching closely.

What’s Happened So Far?

Congress Is Taking Action: Lawmakers grilled Coinbase and other execs about banks freezing crypto accounts without explanation.

Regulatory Moves: The Office of the Comptroller of the Currency (OCC) eased some banking restrictions for crypto, but pressure still lingers behind the scenes.

Executive Orders: President Trump signed an order to investigate and punish banking discrimination against crypto firms and conservative groups — aiming to break the chokehold.

What This Means for Crypto

Banking Access Remains Tough: Crypto companies still face challenges finding reliable banking partners, slowing their operations.

Investor Confidence Wavers: When banks pull back, uncertainty grows, leading to market volatility.

Clear Regulation Is Crucial: This saga highlights the urgent need for clear, fair crypto laws that protect innovation.

The Road Ahead

Operation Choke Point 2.0 isn’t over. The crypto world stays alert as investigations and new legislation could either open doors or keep the chokehold tight.

Final Thoughts

Crypto isn’t just price charts and hype — it’s a fight on multiple fronts: technology, regulation, and banking access. Stay informed, learn the tech (Layer 2 is the future), and watch how Operation Choke Point 2.0 unfolds.

That’s how you stay ahead of the game.